The Securities and Exchange Commission (SEC) approved a new rule in September 2019 under the Investment Company Act of 1940 (’40 Act) allowing Exchange-Traded Funds (ETFs) to go-to-market more quickly without having to apply for specific exemptive relief. The new rule went into effect on December 23, 2019. Because of this new rule, advisers and asset managers may consider adding an ETF to their product line. But there are many variables to consider before deciding to launch an ETF, so it might be helpful to compare it to the familiar mutual fund.

Why the Buzz?

ETFs are a diversified collection of investment assets like mutual funds that are traded on stock exchanges. The new SEC rule levels the playing field for ETF providers so that, with few exceptions, they are now operating under the same rules instead of unique exemptive orders that were previously costly and time-consuming. In addition, Custom Baskets are one of the most significant changes – allowing for more flexibility and the potential to help improve tax efficiency.

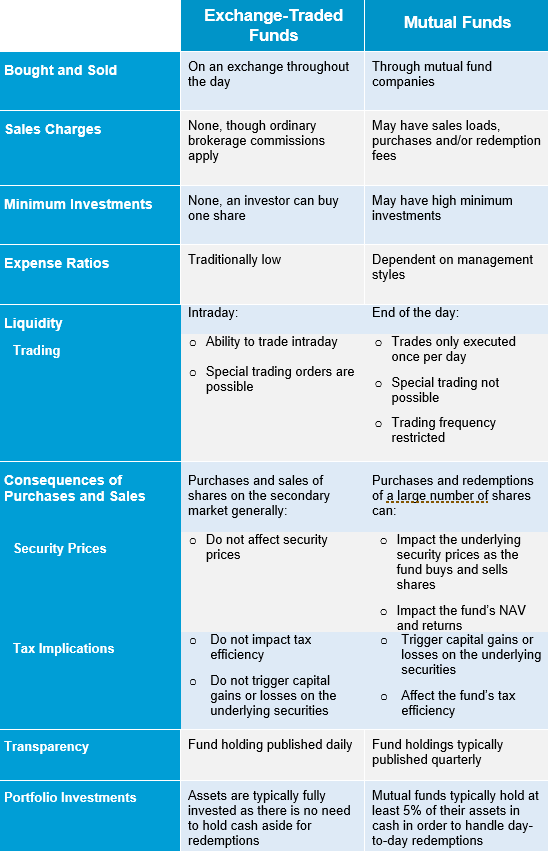

Some differences in fund structures are that ETFs are bought and sold like stock throughout the day, while mutual fund shares are purchased or sold only at the end of the trading day.1 One reason ETFs are of interest is the convenience they afford advisers and investment firms, who can buy and sell entire baskets of stocks or bonds on the secondary market, allowing for flexibility to rebalance or adjust portfolios. Below is a helpful chart of both fund structures for advisers and asset managers to consider.2

Realities to Consider

Since both ETFs and mutual funds are made up of a mix of assets, the two are similar in structure. Though there’s no perfect fund product, advisers and asset managers need to understand the pros and cons of each before deciding if either investment vehicle provides additional opportunities to attract more assets. When researching the nuances of mutual funds and ETFs, there are many variables to consider. The most important variables include creation size and fees, expense ratios, price, stability, and trading platform options. To understand the impact of these nuances for both types of investment vehicles, asset managers can consult with a knowledgeable and trusted fund administrator before launching any new registered product.

Complexity of Incentive Payments

While ETFs do have the benefit of no onboarding requirements and ongoing transaction fees at large trading intermediaries, they do face onboarding requirements as mutual funds do at the full-service wire houses and broker dealers. Requirements vary between intermediaries and may range from assets under management (AUM), length of track record, trading volume and in some cases, platform fee requirements. A full-service fund administrator with years of experience and distribution knowledge can help advisers navigate the complexities of both ETFs and mutual funds to help grow assets under management.

Takeaways

Both ETFs and mutual funds are useful tools, and asset managers have successfully invested in both with different strategies. ETFs, index mutual funds, and actively managed mutual funds can provide broad, diversified exposure to an asset class, region, or a specific market niche. These can be useful selling tools for advisers to have in their product line up, since many investors benefit from owning a mix of these funds.3

Advisers, asset managers, and investment firms will want to be prepared with comparison ratings charts, tax considerations, regulatory requirements, legal considerations, and other factors when investors ask about the pros and cons of investing in mutual funds and/or ETFs. Many important market considerations will need to be studied by both advisers and investors to determine the best strategies moving into 2020.

The effective new rule means it’s easier to establish an ETF, making it a more viable channel for investment advisers to consider. Therefore, if you choose to launch an ETF and/or a mutual fund, seek out a well-established, consultative partner with full fund administration services and advanced technology solutions to help you handle the complexities and sophistication of either fund type.

Ultimus partners with its investment manager clients to provide customized services throughout the entire life cycle of registered funds. The company helps guide investment advisers through strategy and product development, SEC filing, launching, and fund distribution, while also providing ongoing administration, accounting, reporting, and compliance. To learn more, visit www.UltimusFundSolutions.com and fill out the Contact Us form.

Ultimus Fund Solutions, LLC provides fund distribution services through its affiliated broker-dealers: Ultimus Fund Distributors, LLC. and Northern Lights Distributors, LLC. Each of which is a registered broker-dealer and member of FINRA. ETFs and Mutual Funds are subject to market risk, including loss of principal